India surfing the 'Start-up' waves.

- Ivjyot Singh Oberoi

- Aug 17, 2019

- 7 min read

Updated: Dec 28, 2019

Preceding Economic Surveys have observed that nations improve their Gross Domestic

Product using three ways. They are Geology, Geograph and Jeans -to-Jet. India under 'Geology' lacks sufficient crude oil reserves. Moreover, she still requires effective technologies for large scale exploration of Shell gas and nuclear materials. Under 'Geography' though she is blessed with a rich climatic and cultural diversity - which boosts tourisms-, a large nation such as India cannot be sustained by tourism alone. Furthermore, 'Jeans to Jet' suggests that as an agrarian economy evolves, it begins producing items requiring low skill levels - such as jeans and other

textiles. Further growth pushes the nation to produce software, jets and other high skilled goods and services. Many nations such as - USA, China, Thailand have followed this cycle. In dichotomy, India's case is peculiar because post the 1991 Economic reforms, we directly jumped from Agriculture to the Service sector. Attributed to this our growth in the

manufacturing sector has been sub-optimal. If India has to grow towards a $5 Trillion economy by 2022, it must reap the available demographic dividend. Growth of the start-up ecosystem, specialising in manufacturing, is one way of answering how it can be done. Though start-ups in the services sector are equally important in pushing the wheel of economy, the advantage of establishments involving manufacturing is that they absorb the unemployed labour after minimum skilling. For a nation that is beset with high population and unemployment, such start-ups can be a key to the solution.

Indian Start-up story; how corporates are adjusting with the same.

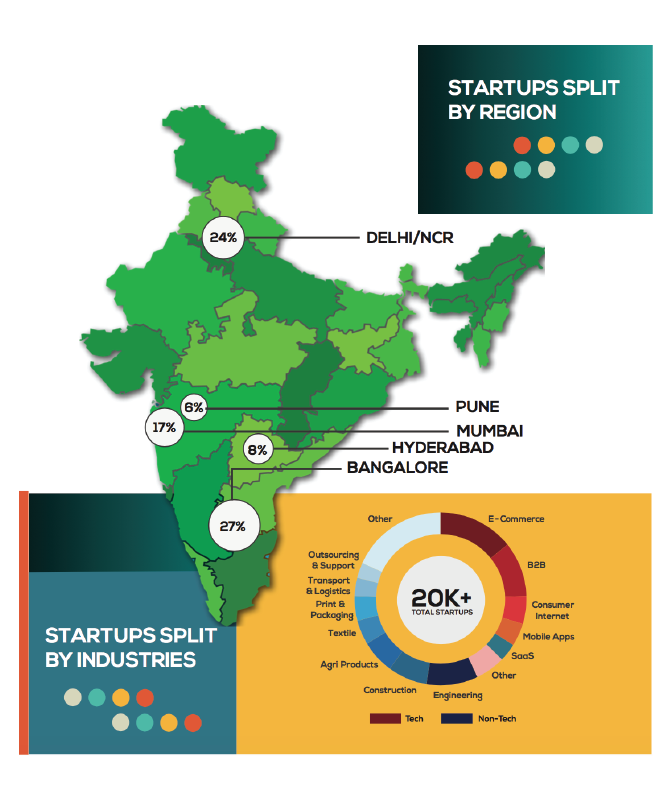

Start-up is defined as "an entrepreneurial ventureor a new business in the form of a Company, a partnership or temporary organisation designed and search of a repeatable and scalable business model." As government data puts it "India has the 2nd largest start-up ecosystem in the world; expected to witness YoY growth of 10-12%" It hosts around 20,000 start-ups out of which around 4750 are technology-driven. In 2016, 1400 new tech start-ups were born -indicating 3-4 tech start-ups are established every day. (See the start-up split by region and industries in Fig 1)

Understanding the potential, India was quick enough to tailor its policy. The scheme Start-Up India, commenced in 2016 under the Ministry of Commerce, was recently revised in February 2019. It updated the norms that defined "start up". The cap on time was increased from 7 to 10 years and the turnover limit was raised from 25 crores to 100 crores. Taking this positive cue from the government the private corporate sector has done satisfyingly well in developing the start-up industry. One good example of the government and private industry tie-up is the mechanism of 'Self Employment and Talent Utilization( SETU)' which harnesses private- sector expertise for Incubator Setup. With active corporate's participation under the umbrella of SETU, there has been an increase in the number of start-ups by incubation. It has also led to a tad improvement in absorbing unemployment in the country. Under this mentorship of a corporate, the nascent companies relish protection and cost-cutting. Few corporates even extend their established market and client records during this incubatory stage. A UK Nesta Report (2011) shows that the survival rate of firms under incubation is 85%. This piece of statistics is important for corporate incubators at the time when Forbes mentioned that "90% of Indian start-ups will fail because of lack of innovation". This dichotomous finding concludes the importance of corporate incubators, especially in India.

However, one needs to understand that the benefits in this relationship are two way. These corporate recognise the benefits that they can reap in future as category leaders with the aid of start-up's research and innovation. Such corporates gain insight into new technology demonstrators, that may provide them with a competitive edge over their competition in future. As an adjunct, it even provides them with enhanced internal knowledge and augments the spirit of entrepreneurship.

Accelerators - a new trend among corporates

The role of accelerators in India is fairly new. 10-15 years ago no one emphasised on the need of such establishments. However presently, they form one of the crtical support that enables a start-up to spread its wings. "Accelerators are enablers for start-ups not in terms of the business and educational aspect but also to introduce them to the right network for mentorship, funding and future growth". Often people consider accelerators as synonymous to incubators. However, the difference between them is simple. Accelerators expedite the growth of an existing company, while incubators nurture ideas. So in simple words, accelerators focus on expanding the business while incubators focus more on research and innovation.

Corporates having a presence in multiple nations enable the start-up to access ready-made client details. We often hear the phrase "Data is the new oil". Thus, start-up feeding on this existing data - borrowed from the corporate - acts as one of the biggest benefits which these nascent establishments gain from these accelerators. But, one needs to understand that such accelerators cannot provide a one size fit all methodology for the success of all such start-ups. Justice Kelly, Corporate Innovation Manager at Chinaccelerator & MOXAL even suggests that many of these programs contain flaws that promise inevitable failure, both for the corporate and the startups involved. He further suggests " When corporates engage with startups without a properly-run corporate accelerator, chaos erupts". It is, therefore, clear that only increasing expenditure won't guarantee success. Even PWC’s Global Innovation 1000 data confirms no statistical relationship being present between the amount of money spent and success. Still, companies like Reliance Jio Infocomm and Microsoft have attained some amount of success in supporting and advancing Indian start-ups. Often a problem in Indian accelerators is that the goals of the accelerators don't align with the startup's ambitions. In the long run, this might resist start-up from further growth and may ultimately lead to its collapse. Thus, before associating with the accelerator, its goals, objectives and specialisation must be understood. Many pundits suggest that companies should look for those areas that have a sectorial specialisation over a general. In regards to this Ashish Bhatia, founder and managing director of India Accelerators in an interview with Inc42 said:" Choosing an industry-specific accelerator increases the likelihood that your mission will align with the broader mission of the accelerator.”

Irrespective of specific faults, the role of accelerators in shaping the Indian start-up industry cannot be denied. It's attributed to them that many start-ups today can dream of becoming a giant soon.

Liquidity Flow

The most important instrument that assesses the success of a start-up is the money flow. In India, most start-ups fail because they run out of money. Fig. 3 depicts the annual Venture Capitaliss investments in India over the last 10 years. In 2017, roughly $1.2B (₹ 7,800Cr) was invested over 320+ deals. The similar investment in the US was $84B (₹ 546,000Cr) over 8000+ deals. Though, the total amount of investments in India is much smaller, Venkatesh Gudait, suggests that it does that necessarily equate to funding scarcity for qualified ideas.

Still, the availability does not assure success. The credit management plays a crucial role in the successful control of the start-up. The current ecosystem in India, fortunately, has a plethora of

investors, venture capital funds and angel networks. However, recently, the contentious issue of Angel Tax has created apprehensions within the market. Introduced in the 2013 Budget by the then finance minister Pranab Mukherjee, it was an instrument to curb money laundering.

There are complaints of genuine companies being sent notice and harassed under this tax-label. Though the government was quick to act on it - globally, the internally the damage was done as Indian start-ups are known to attract global funding. Though corporates and incubators have a less role in providing with the capital, Independent organisations termed as Venture Capitalists - domestic and global - show a keen interest in investing their money in start-ups showing keep interest. In the last few years, it was observed that these companies prefer investing during the ideation stage to maximise their returns on their investments. There are many platforms, such as LetsVenture, AngelList, SeedFund that provide good platforms to seek investment.

Recently Flipkart launched its corporate venture capital (CVC) fund to reinvigorate the

relationship between the corporate and start-up vis-a-vis funding. It invests in early-stage startups in India. Global organisations such as Google (Google Ventures), Intel (Intel Capital), Qualcomm (Qualcomm Ventures), Microsoft (Microsoft Ventures) also run such funds.

Complementing the finance should be a comprehensive strategy that must include detailed steps that are to be unfurled according to the demand of the market. E.g. the entry of Burrp was ill-timed. At a time when internet penetration was low, a local food and restaurant recommendation engine didn't make sense. The similar start-ups when launched at a later stage - such as Zomato, DineOut turned out to be successful owing to better timing.

The Road Ahead.

A positive picture of the start-up ecosystem in India is provided by the 'StartupBlink’s Startup Ecosystem Ranking'. It ranks India, 17 among 100 countries, based on its strengths. The report suggests that " it considers not just startups, but also other critical players of the startup ecosystem like coworking spaces, accelerators, investors, leaders, and more". A good rank increases investor confidence, which further ensures the proportional growth of the company. India, sailing on the remnants of corporate IT boom, is blessed to have hardworking, high skilled labour. Also, the manufacturing cost remains a tad low when compared to other countries. The existing corporate conditions have incubated a sense of perseverance and ambition among young entrepreneurs. This provides a favourable environment where a start- up can be incubated and accelerated in sync with the industry demands.

However, particular weakness such as the corporate lethargy, inconsistency and lousy policy has marred the ambitions of various young entrepreneurs. Further, Venture funds have often neglected social impact. Belonging to an economy that has shown a tilt towards sociology since the beginning, this can be a potential threat in the future. Moreover, the ardent labour laws, often resist the stages that enter the manufacturing stage to set up their plants in India. This smothers the opportunity of absorbing the high unemployment rate. However, the recent intervention of the government in consolidating the bulky laws into 4 categories is expected to smoothen up the process. Attributed to it a rise in the Ease of Doing business is expected that increases the investor confidence.

To conclude I stress on the fact that the positive demographic dividend and a large consumer market presents ample opportunities. Venture funding situation in India remains favourable. Money is available for good fundable ideas as with a large population of consumers; any good idea is bound to find its place in the market. Thus, corporates and government must surf on the waves and push India from the category of developing to the category of a developed nation.

Comments